property tax forgiveness pa

2 South Second Street. In Part D calculate the amount of your Tax Forgiveness.

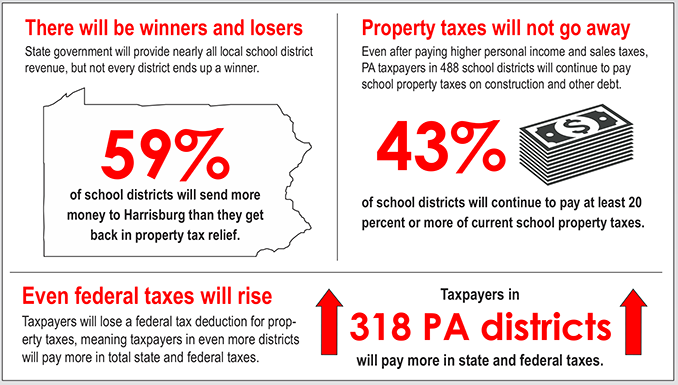

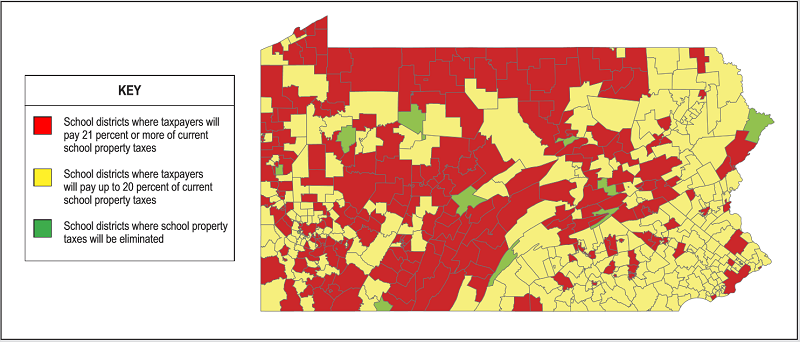

Property Tax Bill Will Cost Pa Taxpayers More

Reduce Your Back Taxes With Our Experts.

. Property TaxRent Rebate Program claimants now have the option to submit program applications online with the Department of Revenues myPATH system. Philadelphia Scranton or Pittsburgh senior households with incomes of less than 30000 can get an increase in their property tax rebate by 50 Senior households from other parts of. This is the first time in.

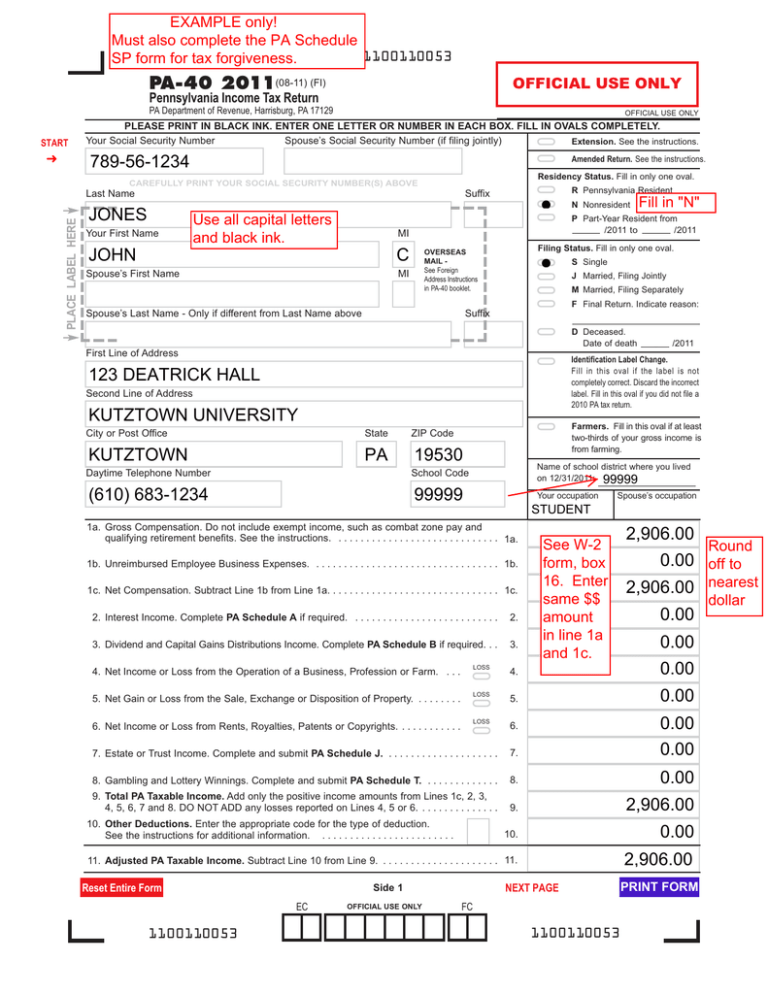

Being a homeowner in Pennsylvania can qualify you for another property tax relief. The one-time bonus rebate will be equal to. Record the your PA tax liability from Line 12 of your PA-40.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all. Posted on December 8 2020. Cherry Township PA.

A The veteran or the unmarried surviving spouse shall request the following two forms from the County Director of Veterans Affairs or the Bureau for Veterans Affairs Fort Indiantown Gap. PA disabled veteran benefits include property tax exemptions. Provides a reduction in tax.

To be eligible a. The homeowner will need to. Ad Owe the IRS.

The penalty for real estate taxes was forgiven through November 30 2020. Pennsylvanians who are approved for a rebate on property taxes or rent paid in 2021 will receive an additional one-time bonus rebate later this year. The amount of tax that is eligible to be forgiven depends on their filing status the income level for the year and the number of dependent children you have if any.

You May Qualify for an IRS Forgiveness Program. Record tax paid to other states or countries. Of course the homeowner must have been delinquent on paying their property taxes and it usually needs to be a recent issue and hardship that the person is facing.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. The program provides real estate tax exemption for any honorably discharged veteran who is 100 disabled a resident of the Commonwealth and has a financial need. A disabled veteran in Pennsylvania may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of wartime service.

PENNSYLVANIA PERSONAL INCOME TAX GUIDE TAX FORGIVENESS DSM-12 03-2019 1 of 9 wwwrevenuepagov. Ad The Leading Online Publisher of National and State-specific Small Business Legal Docs. Tax Forgiveness is determined based on marital status family size and eligibility income.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. If youre a disabled veteran with a 100 percent VA disability rating you may qualify for a complete property tax. End Your Tax Nightmare Now.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Home Services Property Taxes. Properties owned by Non-Bahamians shall be entitled to a waiver of all surcharges payable on outstanding taxes which have been outstanding for more than 180 days provided.

Ad Apply For Tax Forgiveness and get help through the process. Tax Forgiveness is determined based on. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Dauphin County Administration Building - 2nd Floor. Property Tax Penalty Forgiveness.

Infographic Property Tax Relief In Gov Wolf S Budget

Mike Wolf Is A Seasoned Real Estate Investor International Speaker Coach In Turnkey Properties Pa Love My Parents Quotes Outdoor Quotes Inspirational Words

Extend Mortgage Cancellation Tax Relief Real Estate Agent And Sales In Pa Mortgage Debt Mortgage Rates Today Mortgage Loan Originator

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Map Retirement Strategies

Dealing With This Kind Of Debt Is A Hassle And A Headache For Anyone Involved Tax Debt Difficult Conversations Debt

So That S What It Takes To Get A Little Property Tax Relief Editorial Cartoon Pennsylvania Capital Star

Pocono Property Taxes Are Worst In Pa

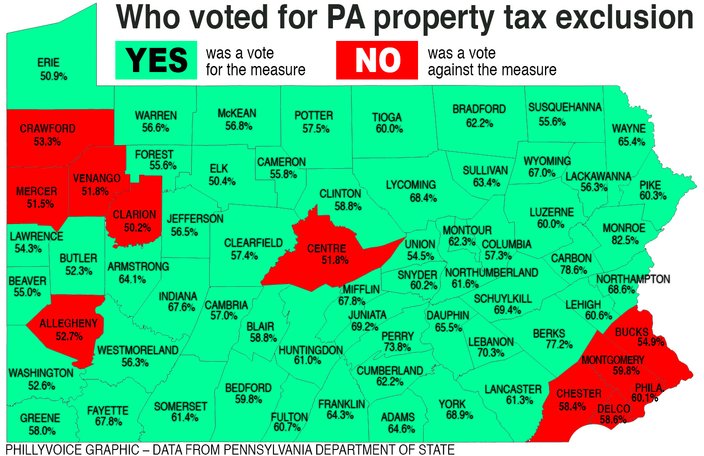

Map Here S Who Voted For Property Tax Exclusion In Pennsylvania Phillyvoice

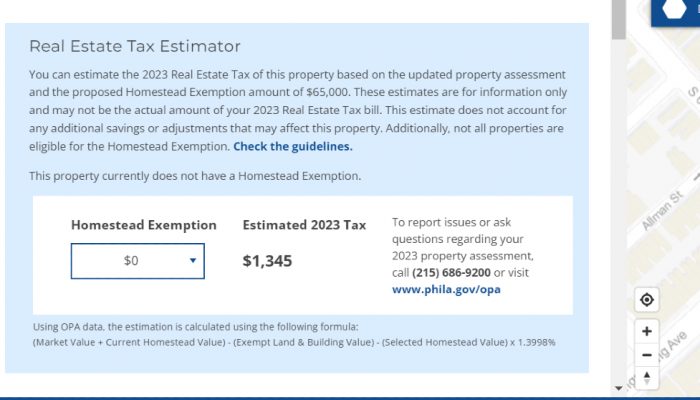

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Pennsylvania Homestead Tax Relief The Commonwealth Of Pennsylvania S State Government Enacted Bullying Laws School Bullying Masters In Business Administration

Property Tax Bill Will Cost Pa Taxpayers More

State By State Guide To Taxes On Retirees Kiplinger Retirement Locations Retirement Retirement Planning

After You Win The Lottery Hire A Taxlawyerlosangeles You Are Not A Tax Lawyer Or An Accountant After Winning It Irs Taxes Tax Attorney Debt Relief Programs

State By State Guide To Taxes On Retirees Kiplinger

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates